Decoding Pinnacle: Market Limit vs. Outcome Limit – What’s the Real Difference?

Most recreational bettors only ever see the maximum amount they can bet on a specific slip. However, sharp bettors and data analysts know that underneath that number lies a more important metric that dictates the structure of the event.

To truly understand market liquidity, you must distinguish between the Outcome Limit and the Market Limit. Here is the breakdown.

1. The Outcome Limit (The "Max Bet")

This is the value most bettors are familiar with. It is the tangible "Max Bet" button on the Pinnacle interface.

Definition: The Outcome Limit is the absolute maximum stake Pinnacle will accept for a specific selection at the current odds.

If you are betting on a heavy underdog, this number will be lower. If you are betting on a heavy favorite, this number will be higher.

- It changes constantly: Because the Outcome Limit is mathematically tied to the odds, every time the odds tick up or down, the Outcome Limit fluctuates slightly to keep Pinnacle’s liability consistent.

2. The Market Limit (The "Base Value")

This is the metric that matters for market analysis. The Market Limit isn't always explicitly shown on the bet slip, but it is the "parent" value from which the Outcome Limit is calculated.

Definition: The Market Limit is the general liquidity value assigned to the entire betting market (e.g., Moneyline, Handicap, Totals) by the trader.

Think of the Market Limit as the "Tier" of the event.

- Champions League Final: Massive Market Limit (e.g., €50,000+ base).

- ITF Tennis: Small Market Limit (e.g., €500 base).

Pinnacle uses this general value to calculate how much they are willing to lose on any given outcome, and then reverse-engineers the Outcome Limit based on the price.

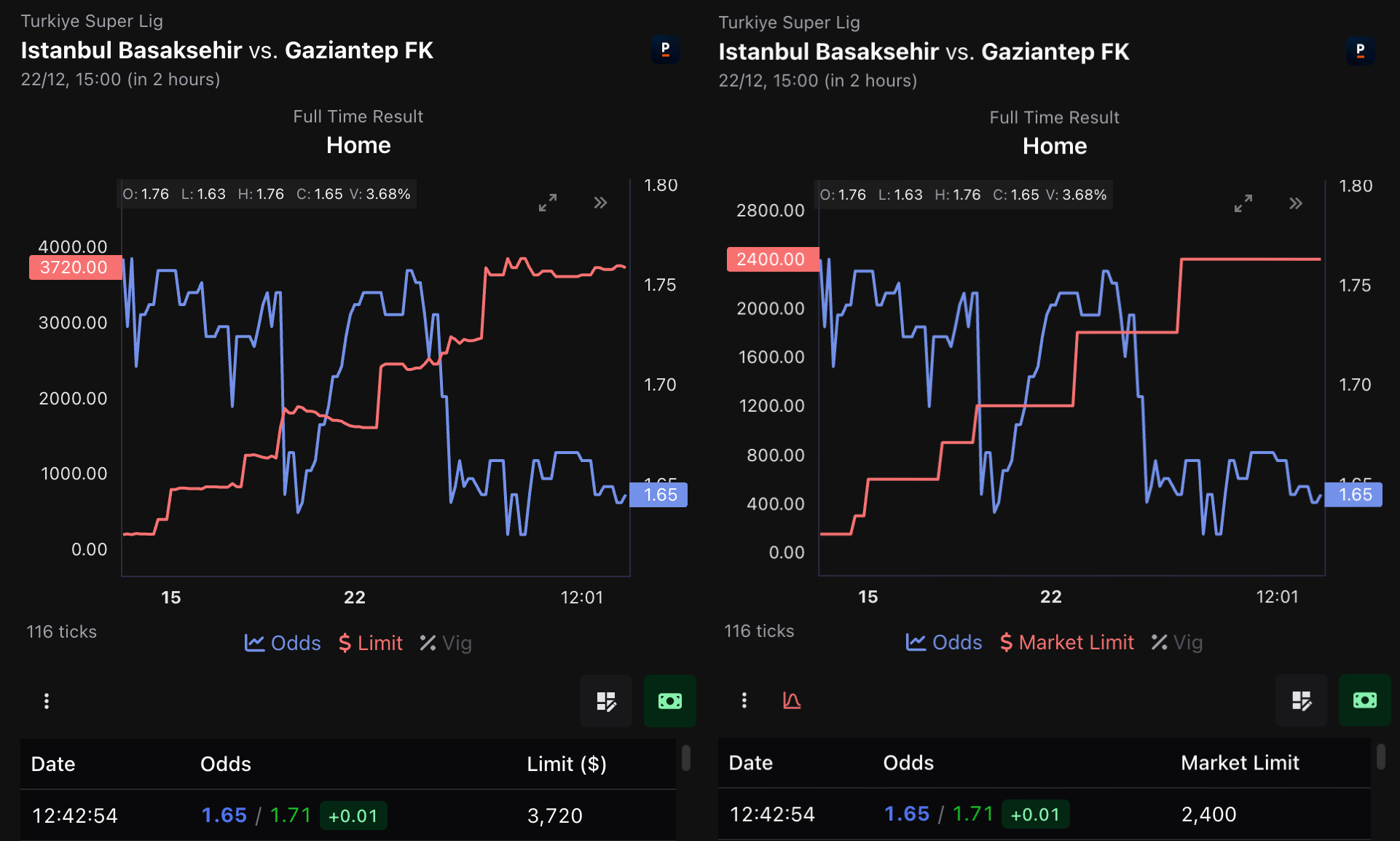

The same match as before, but with the market limits

The same match as before, but with the market limits

The Relationship: Why they are different

Why does Pinnacle give you a higher limit on a 1.20 Favorite than a 5.00 Underdog? Liability.

Pinnacle generally manages limits based on how much they stand to pay out, not just how much they take in.

- The Math (Simplified): The Market Limit generally represents the maximum risk Pinnacle wants to take.

- The Result:

- Outcome Limit A (Favorite): High stake limit (because the payout liability is low).

- Outcome Limit B (Underdog): Low stake limit (because a small bet creates a massive liability).

Why this distinction matters for Alerts

This is the most critical part for BetUnfair users. If you are setting up alerts, you need to know which limit is changing.

The Problem with monitoring Outcome Limits only:

If you only monitor the Outcome Limit, you will get "False Positives."

- Scenario: The odds on Team A move from 2.00 to 1.95.

- Result: The Outcome Limit will naturally change slightly because the math changed.

- Conclusion: This is NOT a signal. This is just a recalculation. Pinnacle hasn't necessarily changed their confidence in the market; the price just moved.

The Power of monitoring Market Limits:

When the Market Limit changes, it is a deliberate action by the trading team.

- Scenario: The Market Limit jumps from €5,000 to €15,000.

- Result: All Outcome Limits across that market increase proportionally.

- Conclusion: This IS a signal. It means Pinnacle has manually "upgraded" the event. They have more liquidity, more confidence, or are inviting more sharp action to shape the line.

Do you see the difference here?

Do you see the difference here?

Summary

| Feature | Outcome Limit | Market Limit |

|---|---|---|

| What is it? | The max stake for a specific bet. | The liquidity tier for the whole event. |

| Visible on site? | Yes, on the bet slip. | Hidden (Background calculation). |

| Volatility | High (Changes with every odds tick). | Low (Changes only on trader decisions). |

| Best for Alerts? | No (Too much noise). | Yes (High signal-to-noise ratio). |

How BetUnfair handles this

At BetUnfair, we understand that professional bettors are looking for signals, not noise.

Our alerting system is sophisticated enough to differentiate between a simple odds adjustment and a genuine Market Limit change. When you receive a Limit Change alert from us, you know it represents a real shift in Pinnacle's market posture—giving you the true "Market Limit" view that allows you to spot value before the rest of the world catches up.